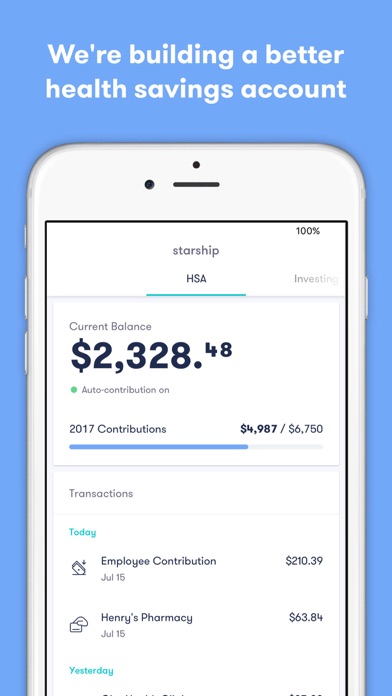

With a triple tax break and no hidden fees, Starship is empowering individuals and families to plan for their future health.

Starship is a financial technology company, not a bank. Banking services provided by nbkc bank, Member FDIC.

How it works:

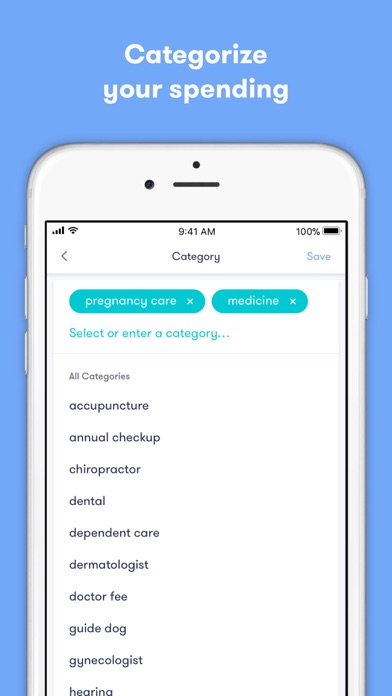

• Save - Save for everyday health expenses like dental, vision, health emergencies, and much more while avoiding hidden banking fees – for yourself or your entire family.

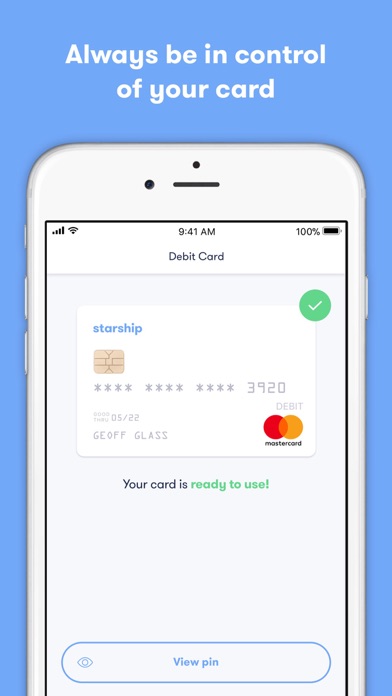

• Spend - Order your free Starship Visa® Debit Card directly from the Starship app. Swipe, dip, or tap your card to make eligible health purchases in-store and online. Add your card to Apple Pay.

Here’s why thousands are saving with Starship:

HEALTH SAVINGS SIMPLIFIED

New to health savings? We have the modern tools and services to help.

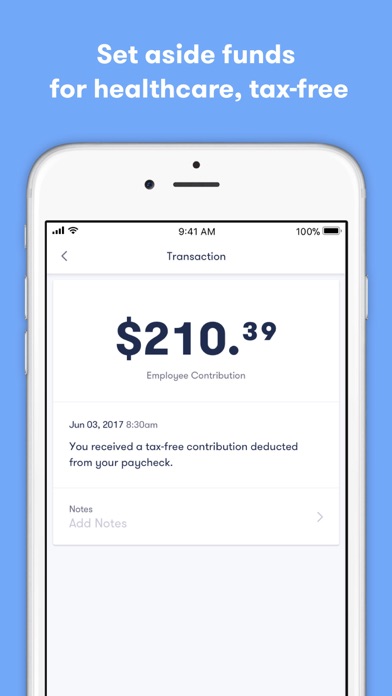

TRIPLE TAX BREAK

Get tax breaks on contributions, interest earned, & health-related purchases.

NO HIDDEN FEES

Ever. You shouldn’t have to spend money to save it. Starship has no overdraft fees, no withdrawal fees, and no minimum balance fees.

SAFE & SECURE

Your security is our top priority. Starship sends you transaction alerts when you turn on notifications, so you know what’s happening with your money.

PAY YOURSELF BACK

Easily withdraw funds for money spent on out-of-pocket health purchases.

SUPPORT

Reach out to [email protected] or chat with us in the app. Our team provides personalized guidance and knowledge on how to make the most of your health savings.

–

Starship is a financial technology company, not a bank. Spending Accounts and the Starship Visa® Debit Card provided by and issued by nbkc bank, Member FDIC. Balances in your Starship Spending Account (“Spending”) earn .01% Annual Percentage Yield (“APY”) on deposit balances $0.01 – $1,999.99 and .04% APY on deposit balances $2,000 and above. We use the Spending Account’s end of day balance to calculate the interest earned that day. The rates are effective as of October 1, 2021, are variable and subject to change after the account is opened. Accounts subject to approval.

Any balances you hold with nbkc bank, including but not limited to those balances held in Starship accounts are added together and are insured up to $250,000 per depositor through nbkc bank, Member FDIC. nbkc bank utilizes a deposit network service, which means that at any given time, all, none, or a portion of the funds in your Starship accounts may be placed into and held beneficially in your name at other depository institutions which are insured by the Federal Deposit Insurance Corporation (FDIC). For a complete list of other depository institutions where funds may be placed, please visit https://www.cambr.com/bank-list. Balances moved to network banks are eligible for FDIC insurance once the funds arrive at a network bank. To learn more about pass-through deposit insurance applicable to your account, please see the Account Documentation. Additional information on FDIC insurance can be found at https://www.fdic.gov/resources/deposit-insurance/.

Content presented is not intended as legal, tax, financial or medical advice. It is the member’s responsibility to ensure eligibility requirements for contributions and qualified medical expenses. Always consult a professional tax advisor before making financial decisions with tax implications.

For Starship terms & conditions, please visit: https://www.starshiphsa.com/terms-conditions/